America’s current economic problems pose a big challenge for the next president (Trump)

11/05/2024 / By Cassie B.

Economic experts are warning that whoever ends up winning the election will face an uphill battle when it comes to the American economy, and many of the solutions both candidates have put forth to address issues plaguing the economy could end up causing unintended problems.

Right now, many Americans are unhappy with the state of the economy, with families’ financial situations stagnating and credit card debt rising 16% in the last two years. Just 21% of Americans consider business conditions to be “good” right now, marking a huge drop from the nearly 40% who felt this way only five years ago.

Some economists, like RIA Advisors Chief Investment Strategist Lance Roberts, believe that economic indicators are on the verge of a downturn.

He told the Epoch Times: “I think you’re going to start looking at much lower rates of economic growth somewhere sub-2 percent … as consumers become challenged by making ends meet.”

Johns Hopkins University Professor of Applied Economics Steve Hanke adopted a similar view, warning: “The economy is running on fumes and is bound to slow down.”

Hanke also drew attention to the shrinking of the money supply that took place in 2022-2023 that is only partly reversed so far. He said that such contractions have only happened on four occasions since the Federal Reserve was set up in 1913, three of which were associated with recessions and one of which spurred the Great Depression.

Both candidates’ economic proposals have flaws

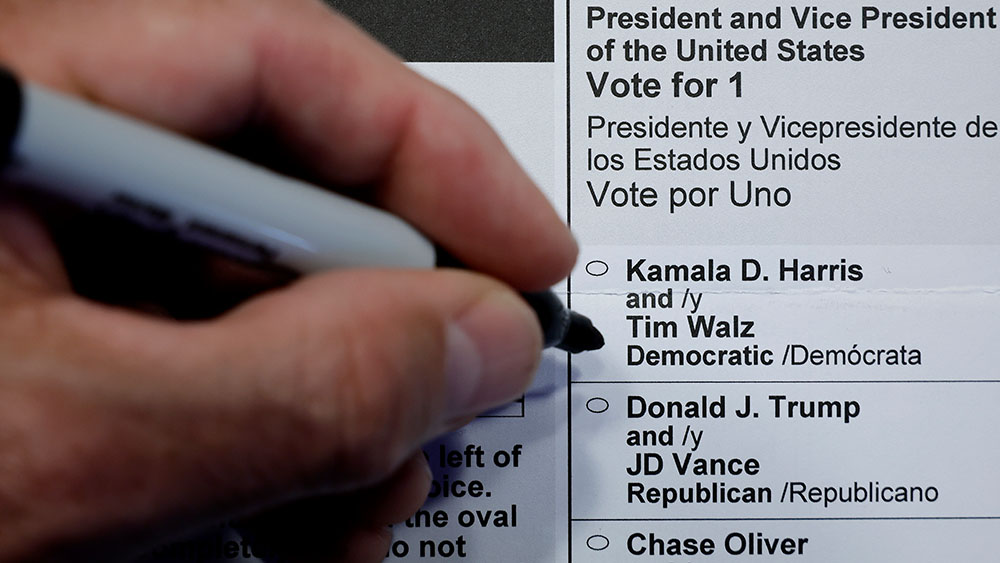

Roberts pointed out that some of the candidates’ proposals for economic improvement could backfire. For example, Kamala Harris has said that she intends to implement a government program that would finance public housing and offer subsidies for down payments for first-time homebuyers.

He says this type of move would only increase the demand for housing construction, which is something that cannot be easily increased given the limited number of people who possess the skills needed for construction.

He cautioned: “You’re trying to solve a housing problem; you’re going to massively create one at that point. If we give $25,000 to 3 million people to go buy houses, there’s not enough houses to buy, and they can’t build them that fast. So that’s going to be very inflationary.”

Housing prices, construction labor, transportation, commodities and everything else connected to the housing supply chain would rise.

And while Trump is generally considered stronger on economic issues and some of his ideas, such as cutting taxes and regulations and boosting domestic energy production, could stimulate the economy, imposing tariffs on imports may not be the best move.

According to Roberts, even if they are calibrated to help reduce their impact on domestic prices, it would place pressure on America’s foreign trading partners and make the markets nervous, which would cause investors to hesitate.

A split Congress could be the best outcome

One potential outcome of the election is that whoever becomes president will not have a majority in both chambers of Congress. This means there would be gridlock and neither party would be able to push things through, and government spending wouldn’t change much.

Roberts explained that this could actually be a positive scenario: “That’s the best outcome for the markets. It’s probably the best outcome for the economy, because nothing actually happens that causes a potential unexpected shock to markets.”

One thing is for certain: Americans are very concerned about the economy going into the election. A YouGov poll conducted in October found that 44% of Americans believe a “total economic collapse” is either somewhat or very likely.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, Donald Trump, economic collapse, economic riot, economy, Harris, Inflation, Kamala Harris, pensions, stock market, tariffs, Trump, whitehouse

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BIG GOVERNMENT NEWS