To avoid margin calls, European energy companies need another $1.5 trillion in bailout money

09/23/2022 / By Ethan Huff

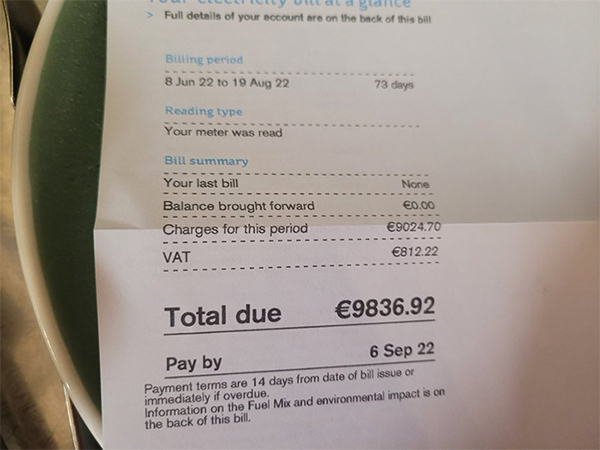

Massive overleveraging by Europe’s energy sector threatens to leave our neighbors across the pond in the dark this winter.

Unless $1.5 trillion is pulled out of thin air to avoid margin calls, European energy companies are in serious trouble, according to Norwegian energy group Equinor.

Several European countries are desperately trying to keep the energy companies afloat with billions of dollars in bailouts, which Reuters is calling “support.” This money is being used to cover collateral payments on trades.

These billions might sound like a lot – and to you and I, it is a lot. But it is just a drop in the bucket when it comes to plugging the multi-trillion-dollar hole that is sinking the financial Titanic.

“Utilities often sell power in advance to secure a certain price, but must maintain a ‘minimum margin’ deposit in case of default before they supply the power,” Reuters explains.

“This has raced higher with soaring energy prices triggered mainly by Russia slashing gas supplies to Europe, leaving firms struggling to find cash. (Related: More than half of England’s manufacturing economy is on the brink of closure due to soaring energy costs.)

Will 2022 make 2008 look like a walk in the park?

Helge Haugane, Equinor’s senior vice president for gas and power, told Reuters that in Europe, excluding Great Britain, these margin calls are teetering around 1.5 trillion euros, which is squeezing market liquidity and hitting small- and medium-sized firms especially hard.

“It is a function of the price, it keeps going up and up,” Haugane said, stressing what he sees as an urgent need for government intervention.

“The market can function a lot better than what it is doing right now further out in the curve because people don’t have enough liquidity to play.”

Compared to a year ago before Russia’s invasion of Ukraine, gas prices in Europe are now five times higher. They jumped even higher this week after Moscow announced that the Nord Stream 1 (NS1) natural gas pipeline will remain offline indefinitely.

The only way to fix the problem in the short term, in Haugane’s view, is to massively reduce demand for energy. But apart from wide-scale genocide, how can this be accomplished?

There are also price caps that the government could implement, but these will not ultimately solve the gargantuan overleveraging problem. The big boys once again gambled away the economy, and taxpayers, assuming they survive the upcoming dark winter, will once again be expected to bail them out.

The same thing occurred back in 2008, by the way. The “too big to fail” mantra was used to bail out the market manipulators who gambled away people’s pensions. What is brewing in 2022, however, appears significantly larger than 2008.

In fact, some would argue that the financial crisis of 2008 was never actually solved, but that the bailouts simply kicked the can down the road. That can is once again in sight, and we are now approaching it like a runaway train via the energy markets.

“In case the Russian volumes halt completely, the demand reduction needs to be even larger than what we so far have experienced, and no price cap or anything like that can solve the underlying problem,” Haugane says.

European officials are considering imposing a price cap on imported gas, as well as on gas used to produce electricity. They are also looking at temporarily removing gas power plants from the current European Union (EU) system of setting electricity prices.

Back in July, the EU asked its 27 member states to voluntarily reduce gas demand by at least 15 percent before winter. If that does not happen, then EU officials will consider making such reductions mandatory.

As the global economy goes dark this winter, we will keep you up to date with the latest at Power.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, Collapse, electricity, energy, energy crisis, Europe, fuel supply, government debt, Inflation, margin call, market crash, power, power grid, rigged, Russia, sanctions, supply chain warning

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BIG GOVERNMENT NEWS