California FAILS federal program audit: More than half of COVID unemployment benefits are in question

04/08/2025 / By Willow Tohi

- A state audit found California in noncompliance with 7 out of 22 federal programs, including “pervasive” failures in the unemployment benefits program, risking federal funding.

- The state likely made 200M in ineligible payments in 2023, with 66% of sampled claimants having verification issues.

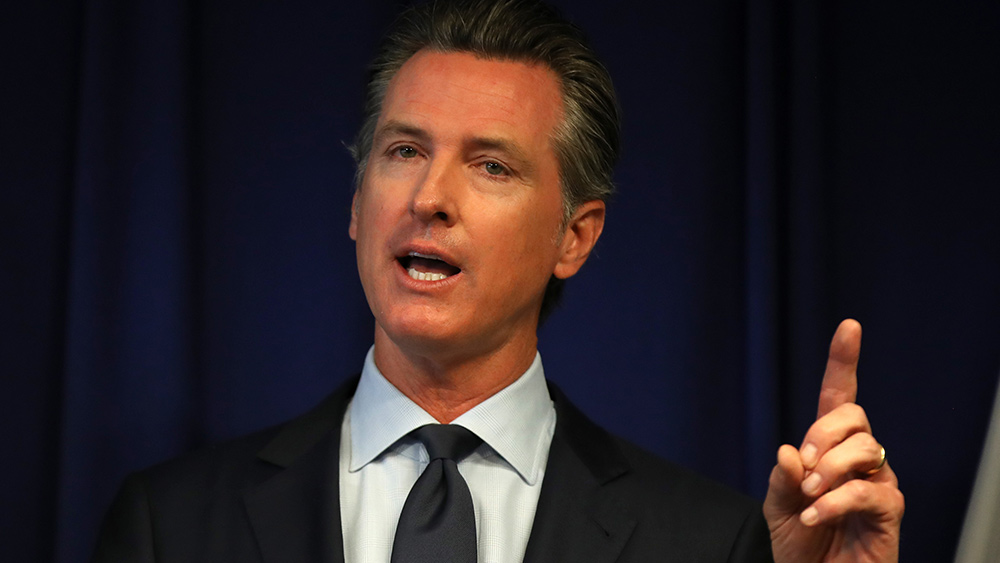

- Lawmakers, like Assembly Minority Leader James Gallagher, blame Governor Gavin Newsom’s administration for mismanagement and failing basic governance duties.

- The audit raises alarms about withheld federal funding and long-term economic harm, urging reforms to restore accountability and trust.

California’s state government has been found to be in noncompliance with the requirements of seven out of 22 federal programs, according to a recent audit by the state auditor. The audit, which highlights “pervasive” noncompliance in the unemployment benefits program, raises significant concerns about the state’s ability to manage federal funds and could jeopardize essential federal funding.

Audit reveals widespread noncompliance

The audit, conducted by Deputy State Auditor Linus Li, concluded that California did not materially comply with the requirements for seven federal programs, including one where noncompliance was pervasive. The report states, “This report concludes that the State did not materially comply with certain requirements for seven of the 22 federal programs or clusters of programs (federal programs) MGO audited, including one program for which the noncompliance was pervasive.”

The audit also noted that while the state complied with the remaining federal programs, it continues to experience deficiencies in its accounting and administrative practices, affecting its internal controls over compliance with federal requirements.

Unemployment benefits program under scrutiny

One of the most critical findings of the audit pertains to the state’s unemployment benefits program. The report found that even in 2023, years after the state made 55 billion in fraudulent COVID lockdown?era benefits payments, the state likely made “potentially ineligible payments” of nearly 200 million. Of the 138 pandemic unemployment assistance claimants tested, 91, or 66%, had verification issues.

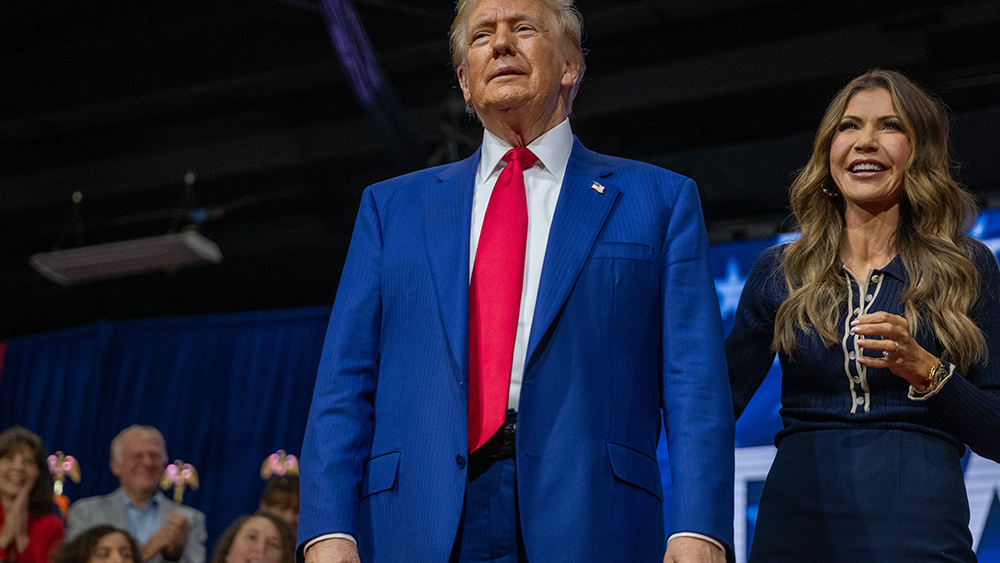

California State Assembly Minority Leader James Gallagher criticized the administration, stating, “While Gavin Newsom chases the national spotlight, Californians are left with an administration that can’t accomplish the basic functions of government. The federal government is right to take a look at this spending and decide if it’s appropriate to keep throwing resources at an administration that treats it like Monopoly money.”

Structural deficit and payroll tax hikes

The audit’s findings are particularly concerning given the state’s ongoing structural deficit in its unemployment fund. According to the Legislative Analyst’s Office (LAO), the state’s unemployment fund runs a structural deficit of $2 billion per year, in addition to a $20 billion debt and $1 billion in annual interest payments to the federal government.

To address this deficit, the LAO has recommended a significant increase in payroll taxes. Currently, businesses pay 42 per employee making 46,800 or more per year. However, the LAO suggests that this amount would need to rise to $889.20, or over 21 times higher than the existing base payroll tax, to cover the state’s insolvency.

Historical context and future implications

The audit’s findings are not just a reflection of current administrative failures but also highlight a long-standing issue with California’s management of federal funds. The state’s unemployment benefits program has been a source of controversy since the onset of the COVID-19 pandemic, with widespread reports of fraud and mismanagement.

The implications of this audit are far-reaching. If the federal government decides to withhold funding due to noncompliance, it could have severe economic consequences for the state. Additionally, the proposed payroll tax hikes could place a significant burden on businesses, potentially leading to job cuts and economic slowdown.

Conclusion

The state auditor’s report underscores the critical need for improved oversight and accountability in California’s management of federal programs. As the state grapples with the fallout from the audit, it is clear that significant reforms are necessary to restore public trust and ensure the responsible use of taxpayer dollars. The federal government’s response to these findings will be closely watched, as it could set a precedent for how other states are held accountable for their use of federal funds.

Sources include:

Submit a correction >>

Tagged Under:

benefit programs, big government, California, california collapse, chaos, Collapse, corruption, debt collapse, federal audit, fraud, insanity, left cult, money supply, outrage, real investigations, suppressed, Taxes, welfare

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BIG GOVERNMENT NEWS