Inflation remains a problem for middle- and lower-income Americans as Biden’s Federal Reserve keeps raising interest rates

03/29/2023 / By Arsenio Toledo

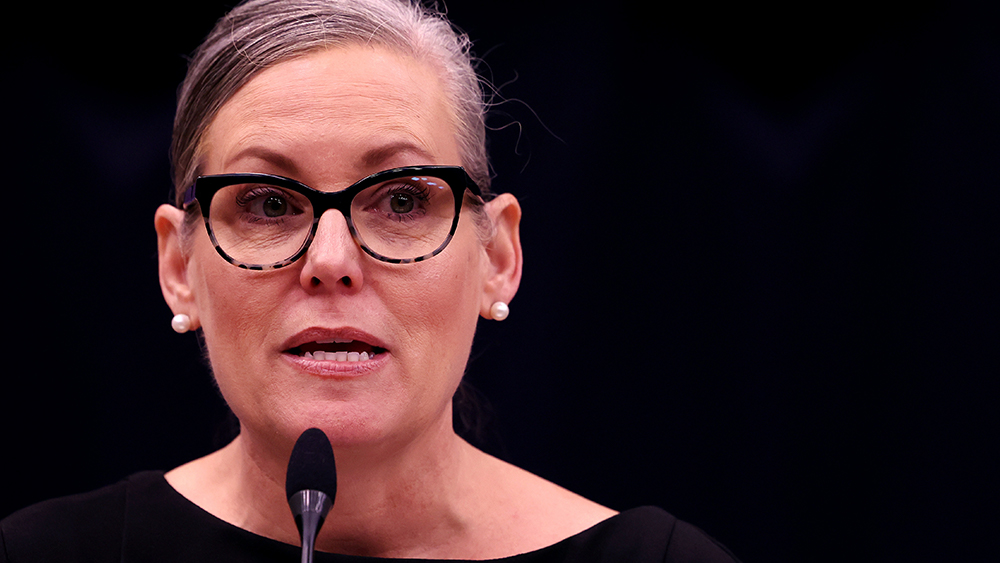

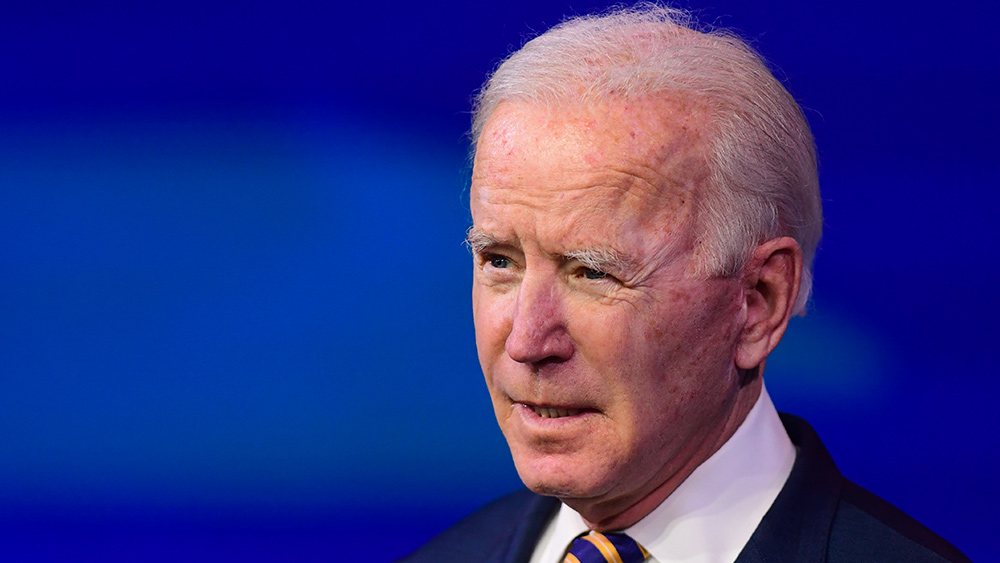

Inflation continues to haunt middle and lower-income working folks in the United States as the administration of President Joe Biden is still unable to properly resolve the inflation crisis.

In an interview with Fox Business, conservative economist and commentator Larry Kudlow talked about it and blamed Biden’s policies for the ongoing situation. (Related: Federal government hides true rate of inflation by changing how CPI is calculated.)

“Big time pessimism is out there and Joe Biden owns it because inflation is the cruelest tax of all. It continues to haunt middle and lower-income working folks. It has driven up interest rates on credit cards, home mortgages, car loans, et cetera. Inflation is rising faster than wages and government spending and bank bailouts have gotten under the skin of Americans,” said Kudlow.

“I don’t really want to say America is in decline, but I do fret and I will say for the umpteenth time: We need leadership that will be a guardian for economic growth and prosperity and then good old-fashioned values will soon return to a more confident America.”

Inflation still running at a high pace, Americans very concerned

A survey by the Conference Board, a non-profit business research organization, noted that Americans are optimistic that the American economy will get better in the near future.

But despite the slightly higher consumer confidence, inflation expectations remain very high. Americans expect prices to rise by at least 6.3 percent in the next 12 months, similar to how survey participants felt about the economy in February.

Ataman Ozyildirim, senior director of economics at the Conference Board, explained that consumers are more likely to feel confident about their future economic prospects while remaining “slightly less optimistic about the current landscape.”

This is supported by a Wall Street Journal-National Opinion Research Center poll, which found that nearly two-thirds of Americans believe inflation is a major concern.

“No matter how much they increase your pay, everything else is going up,” said Kristy Morrow, a coordinator for a hospital in Big Springs, Texas, in an interview with the Wall Street Journal.

To make matters worse, the Federal Reserve just increased interest rates by 25 basis points (0.25 percent) this March, the ninth interest rate hike since last year. This increase takes the benchmark federal funds rate to a target range of between 4.75 percent and five percent. This rate sets what banks charge each other for overnight lending and feeds into the rates of consumer debt like auto loans, credit card debt and mortgages.

“The process of getting inflation back down to two percent has a long way to go and is likely to be bumpy,” said Fed Chair Jerome Powell. He also rejected the idea of cutting interest rates to pre-inflation crisis levels for the remainder of 2023.

“We are committed to restoring price stability and all of the evidence says that the public has confidence that we will do so, that will bring inflation down to two percent over time,” Powell added. “It is important that we sustain that confidence with our actions, as well as our words.”

“[Inflation] would have to be a lot softer to take the hike out. By stopping here, it exposes them to risk of inflation expectations accelerating,” claimed Tom Simons, money market economist for investment banking group Jefferies. “If they do that, they are risking having to make bigger moves later when they don’t know what the environment will look like. It makes sense to stay the course and keep everything in check. They do have more work to do.”

Learn more about the Biden administration’s policies at JoeBiden.news.

Watch this clip from the “War Room” on Real America’s Voice as host Steve Bannon talks to Peter Navarro, former special assistant to former President Donald Trump, about how the inflation crisis is solely a product of Joe Biden.

This video is from the News Clips channel on Brighteon.com.

More related stories:

Federal Reserve will keep increasing interest rates despite worsening banking crisis.

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, Collapse, debt bomb, debt collapse, economic collapse, economics, economy, Federal Reserve, financial crash, Inflation, Joe Biden, lower class, market crash, middle class, money supply, pensions

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BIG GOVERNMENT NEWS