IRS whistleblower says Inflation Reduction Act will target middle-income taxpayers

08/19/2022 / By Mary Villareal

A former Internal Revenue Service (IRS) whistleblower said the Democrats’ Inflation Reduction Act (IRA) will target middle-income Americans with more scrutiny and audits.

William Henck, who previously worked as a lawyer for the IRS until 2017, was terminated for allegedly revealing sensitive information to the media about how the IRS failed to identify a multi-billion-dollar corporate tax credit scheme that involved black liquor.

Black liquor is a source of energy from burning pulp byproducts. Gasification of black liquor has the potential to achieve higher overall energy efficiency compared with those of conventional recovery boilers while generating energy-rich synthesis gas that can be burned to produce electricity or converted into chemicals or fuels.

Henck also disputed claims made by the IRS and other officials who said that increased funding under the IRA, which is set to be signed into law by President Joe Biden later this week, would only lead to more audits for millionaires and billionaires, as well as large corporations.

The idea that the government will open things up to go after billionaires and large corporations is not going to happen. “They’re going to give themselves bonuses and promotions and really nice conferences,” he said. “The big corporations and the billionaires are probably sitting back laughing right now.”

The Democrat-controlled House passed the IRA in a party-line vote on August 12, with money that included nearly $80 billion in IRS funding, including $45.6 billion for “enforcement.”

Last year, a report from the Department of the Treasury estimated that such an investment would enable the agency to hire around 87,000 employees by 2031. (Related: $80 Billion NBOA – “National Bleed-Out Act” will make sure the IRS can collect your unpaid taxes or medical bills at gunpoint.)

Commissioner insists IRA not about increasing audit scrutiny for average Americans

IRS Commissioner Charles Rettig insisted that the IRA is not about increasing audit scrutiny of small businesses or middle-income households.

“Our investment of these enforcement resources is designed around the Treasury Department’s directive that audit rates will not rise relative to recent years for households making under $400,000,” he said.

Treasury Secretary Janet Yellen and White House Press Secretary Karine Jean-Pierre also doubled down on their rhetoric about the reports of extra funding being utilized to target middle-income Americans. (Related: “Inflation Reduction Act” completely absurd; if you were bleeding out from a wound, you wouldn’t want the doctor to tell you, “we’re slightly reducing the amount of blood you’re losing.”)

Henck disagreed with their narrative. “There will be considerable incentive to basically shake down taxpayers, and the advantage the IRS has is they have basically unlimited resources and no accountability, whereas a taxpayer has to weigh the cost of accountants, tax lawyers – fighting something in tax court.”

This could include car dealerships and roofing companies, according to Henk, whose comments came after the nonpartisan Congressional Budget Office (CBO) found that working-class Americans will end up paying billions in new taxes if the IRA pushes through.

Republicans on the House Ways and Means Committee said they received this information from the CBO, confirming that under the new legislation, lower- and middle-income Americans will end up paying an estimated $20 billion more in taxes over the next 10 years.

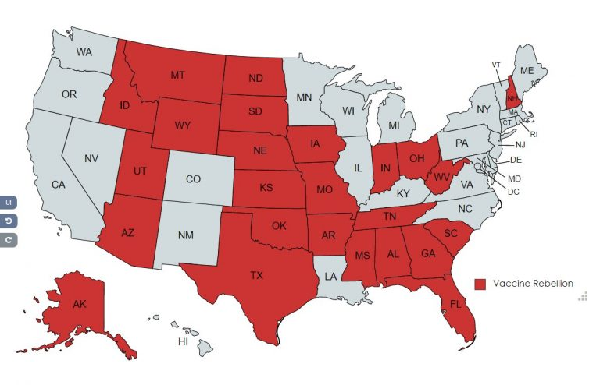

GOP lawmakers said this confirms that “at least $20 billion of the $124 billion in new revenue expected by a supercharged IRS will be coming from higher audits on low- and middle-income Americans,” in addition to existing audits on those income levels.

The Joint Committee on Taxation, which serves as the official tax scorekeeper of Congress, said 78 to 90 percent of the money raised from under-reported income would come from individuals making less than $200,000 a year. Nearly half of the audits would affect those making $75,000 per year or less and only four to nine percent would come from the upper-class market of taxpayers making more than $500,000.

Visit BigGovernment.news for more information about the IRA and how this could affect households in the next decade.

Watch the video below to know more about the misinformation regarding the IRA improving inflation issues for taxpaying Americans.

This video is from the Son of the Republic channel on Brighteon.com.

More related stories:

More high-income Americans are shopping at discount stores due to unrelenting inflation.

Economists warn 1.9 trillion Biden relief bill may trigger runaway inflation.

Inflation “Reduction” bill to unleash TAX TERRORISM upon the American people.

American workers have lost $3,400 in yearly income due to unrelenting inflation.

Sources include:

Submit a correction >>

Tagged Under:

apocalypse, big government, currency, deep state, discrimination, economy, enslaved, finance, government debt, government waste, Inflation, inflation act, Inflation Reduction Act, Internal Revenue Service, IRA, IRS, irs agents, middle class, money, money supply, overlords, privacy watch, propaganda, rising prices, Taxes, Tyranny, whistle-blower, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BIG GOVERNMENT NEWS